The Ultimate Guide to Operations Management Compliance: Everything Central Valley Small Businesses Need to Succeed

- tabitha2750

- Jan 5

- 5 min read

Running a small business in California's Central Valley comes with unique opportunities and challenges. From Fresno to Modesto, Stockton to Bakersfield, local entrepreneurs drive economic growth while navigating complex compliance requirements that can make or break their success.

Operations management compliance isn't just about avoiding penalties: it's about building sustainable systems that protect your business, employees, and customers while positioning you for long-term growth.

What Operations Management Compliance Actually Means

Operations management compliance covers the policies, procedures, and systems that ensure your business meets all applicable federal, state, and local regulations. This includes everything from tax reporting and payroll administration to workplace safety and record-keeping requirements.

For Central Valley businesses, this means understanding regulations that affect agriculture, manufacturing, retail, and service industries that form the backbone of our regional economy.

Federal Compliance Requirements Every Central Valley Business Must Follow

Tax Obligations and Financial Reporting

The IRS requires precise record-keeping regardless of your business size. Small businesses must maintain accurate books showing income, expenses, and deductions. This includes quarterly estimated tax payments for most business structures and annual returns that comply with federal tax codes.

Key federal tax compliance areas include:

Quarterly estimated tax payments

Annual business tax returns (Form 1120, 1120S, or Schedule C)

Payroll tax deposits and reporting

1099 reporting for contractors

Sales tax collection and remittance

Employment and Labor Standards

Federal labor laws apply to most Central Valley businesses with employees. The Fair Labor Standards Act governs minimum wage, overtime pay, and record-keeping requirements. Even small businesses must comply with these standards to avoid costly violations.

Essential federal employment compliance includes:

Minimum wage and overtime calculations

Employee classification (employee vs. contractor)

I-9 employment eligibility verification

Workers' compensation insurance requirements

OSHA workplace safety standards

California-Specific Regulations That Impact Your Operations

California maintains some of the nation's strictest business regulations. Understanding state-level compliance requirements is crucial for Central Valley businesses operating under California law.

State Employment Laws

California employment law often exceeds federal minimums. The state requires higher minimum wages, stricter overtime rules, and additional employee protections that directly impact your operations management.

Critical California employment compliance areas:

State minimum wage requirements (higher than federal)

Meal and rest break requirements

Paid sick leave mandates

California Family Rights Act compliance

State disability insurance contributions

Tax and Licensing Requirements

California requires various business licenses and permits depending on your industry and location. State tax obligations include income taxes, sales taxes, and employment taxes that must be properly calculated and remitted.

Local Central Valley Compliance Considerations

Each city and county in the Central Valley maintains specific business requirements. From business licenses in Fresno to zoning compliance in Kern County, local regulations add another layer of operational requirements.

Municipal Business Licenses

Most Central Valley cities require business licenses regardless of your business size. These licenses must be renewed annually and often require proof of insurance and tax compliance.

Zoning and Land Use Regulations

Agricultural businesses and manufacturers in the Central Valley must comply with local zoning laws that govern where different business activities can occur. Understanding these regulations prevents costly relocations or modifications.

Environmental Compliance

Central Valley businesses in agriculture, manufacturing, or transportation may face additional environmental regulations related to air quality, water usage, and waste management.

How Proper Financial Management Supports Compliance

Effective operations management compliance starts with solid financial systems. Accurate bookkeeping provides the foundation for meeting tax obligations, supporting employment law compliance, and maintaining the records needed for regulatory audits.

Record-Keeping Best Practices

Maintaining complete financial records helps demonstrate compliance with tax laws, employment regulations, and industry-specific requirements. This includes:

Daily transaction recording

Monthly financial statement preparation

Annual tax document organization

Employee payroll and benefits tracking

Payroll Administration Excellence

Proper payroll administration ensures compliance with federal and state employment laws while protecting your business from costly violations. This includes accurate wage calculations, timely tax deposits, and complete employee records.

Building Compliance Systems That Scale

Small businesses need compliance systems that grow with their operations. Starting with solid foundations prevents costly corrections later while supporting business expansion.

Policy Development

Written policies demonstrate your commitment to compliance while providing clear guidance for employees. Essential policies cover:

Employee handbook provisions

Safety and security procedures

Financial controls and authorization limits

Record retention requirements

Regular Compliance Reviews

Quarterly compliance reviews help identify potential issues before they become violations. These reviews should cover financial accuracy, employment law compliance, and regulatory updates affecting your industry.

Technology Tools for Compliance Management

Modern compliance management relies on technology systems that automate routine tasks while maintaining accurate records. Cloud-based accounting software, payroll systems, and document management tools reduce compliance risks while improving efficiency.

Automated Reporting Systems

Automated systems reduce human error while ensuring timely compliance reporting. This includes automated payroll tax deposits, quarterly tax payments, and annual regulatory filings.

Document Management

Digital document management systems ensure regulatory records remain accessible and organized. This supports audit compliance while protecting sensitive business information.

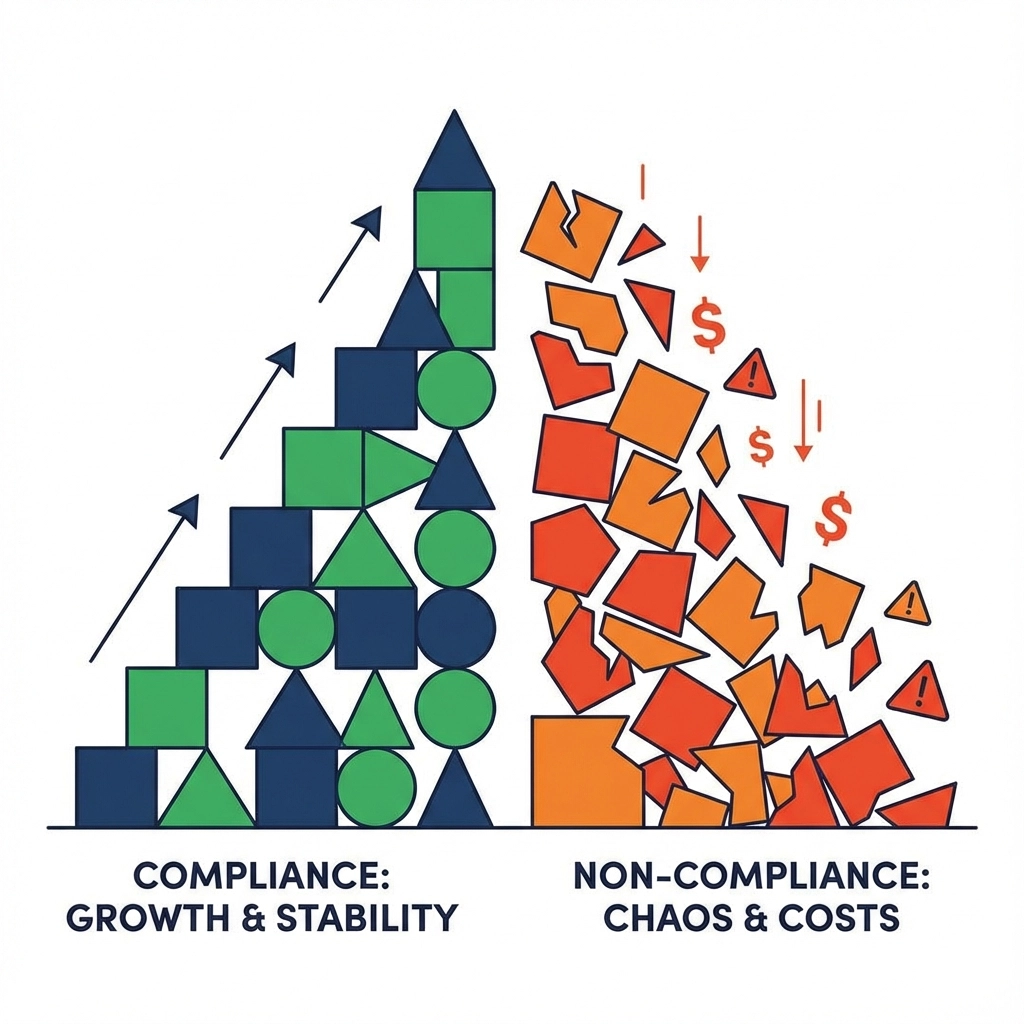

The Cost of Non-Compliance

Non-compliance penalties can devastate small businesses. IRS penalties, labor law violations, and local regulatory fines often exceed the cost of proper compliance systems by significant margins.

Common compliance violations and their costs include:

Late payroll tax deposits: 2-15% penalties

Minimum wage violations: Back pay plus penalties and legal fees

Workers' compensation non-compliance: Fines up to $100,000

Business license violations: Varies by municipality

Professional Support for Operations Management Compliance

Many Central Valley small businesses benefit from professional bookkeeping, payroll, and administrative services that ensure consistent compliance while allowing business owners to focus on growth activities.

Professional services typically include:

Monthly bookkeeping and financial statement preparation

Payroll processing with tax compliance

Quarterly tax planning and preparation

HR policy development and implementation

Regulatory update monitoring and implementation

Taking Action on Compliance

Effective operations management compliance requires ongoing attention and systematic approaches. Start by conducting a comprehensive audit of your current compliance status, then develop systems that maintain ongoing compliance while supporting business growth.

Priority actions for Central Valley businesses include:

Reviewing current bookkeeping and payroll systems

Updating employee policies and procedures

Implementing regular compliance monitoring

Establishing relationships with qualified professional service providers

Success in the Central Valley's competitive business environment requires more than great products or services: it demands operational excellence that includes comprehensive compliance management. Businesses that invest in proper compliance systems protect themselves from costly violations while building foundations for sustainable growth.

Whether you're launching a new venture in Fresno or expanding an established business in Bakersfield, understanding and implementing proper operations management compliance positions your business for long-term success in California's dynamic Central Valley market.

For businesses seeking professional support with bookkeeping, payroll administration, or compliance management, Tabs Bookkeeping Inc provides comprehensive services designed specifically for Central Valley small businesses. Our team understands local regulations and industry requirements that affect your daily operations.

Comments