Stop Wasting Time on DIY Bookkeeping: Try These 7 Quick Automation Hacks for Fresno Businesses

- tabitha2750

- Jan 7

- 5 min read

Let's be honest, if you're still doing your bookkeeping the same way you did in 2020, you're probably spending more time shuffling receipts than actually running your Fresno business. And in a city where the heat can reach 110°F in summer, the last thing you want is your books making you sweat too.

The good news? You don't need a computer science degree or a Silicon Valley budget to automate your bookkeeping. You just need to stop treating your finances like a vintage wine collection and start treating them like the digital-age business they deserve to be.

Here are seven automation hacks that'll have your Central Valley business running smoother than Highway 99 on a Sunday morning.

1. Connect Your Bank Accounts Directly to Your Accounting Software

Remember when downloading bank statements meant printing them out and manually typing every transaction? Yeah, that was never fun, and it's definitely not necessary anymore.

Most accounting software (QuickBooks Online, Xero, FreshBooks) can connect directly to your bank accounts and credit cards. This means your morning coffee run to Kuppa Joy, that equipment purchase from a Fresno supplier, and yes, even that late-night DoorDash order during tax season all get automatically imported.

The hack: Set up bank feeds for all your business accounts. Your software will download transactions daily, categorize recurring expenses automatically, and flag anything unusual. It's like having a bookkeeper who never sleeps and doesn't judge your spending habits.

2. Automate Your Recurring Transactions

If you're paying rent on your warehouse in southeast Fresno every month, utilities for your downtown office, or that same software subscription that somehow keeps increasing in price, why are you manually entering these transactions?

Most accounting platforms let you set up recurring transactions that post automatically. Set it once, forget it forever (until the landlord raises rent, but that's a different problem).

The hack: Create recurring transaction rules for anything that happens monthly, quarterly, or annually. Your rent, insurance, loan payments, and subscription services can all run on autopilot while you focus on what actually makes money.

3. Use Receipt Scanning Apps That Actually Work

Gone are the days of shoving crumpled receipts into a shoebox (please tell me you've moved past the shoebox method). Apps like Receipt Bank, Expensify, or even your accounting software's mobile app can scan receipts instantly.

Take a photo of that receipt from Valley Ag Supply, and the app extracts the vendor, amount, date, and even suggests the expense category. It's basically magic, but the kind that actually helps your business comply with tax requirements.

The hack: Install your accounting software's mobile app and make receipt scanning a habit. Do it right after the purchase, while you're still in the parking lot, and you'll never lose another receipt.

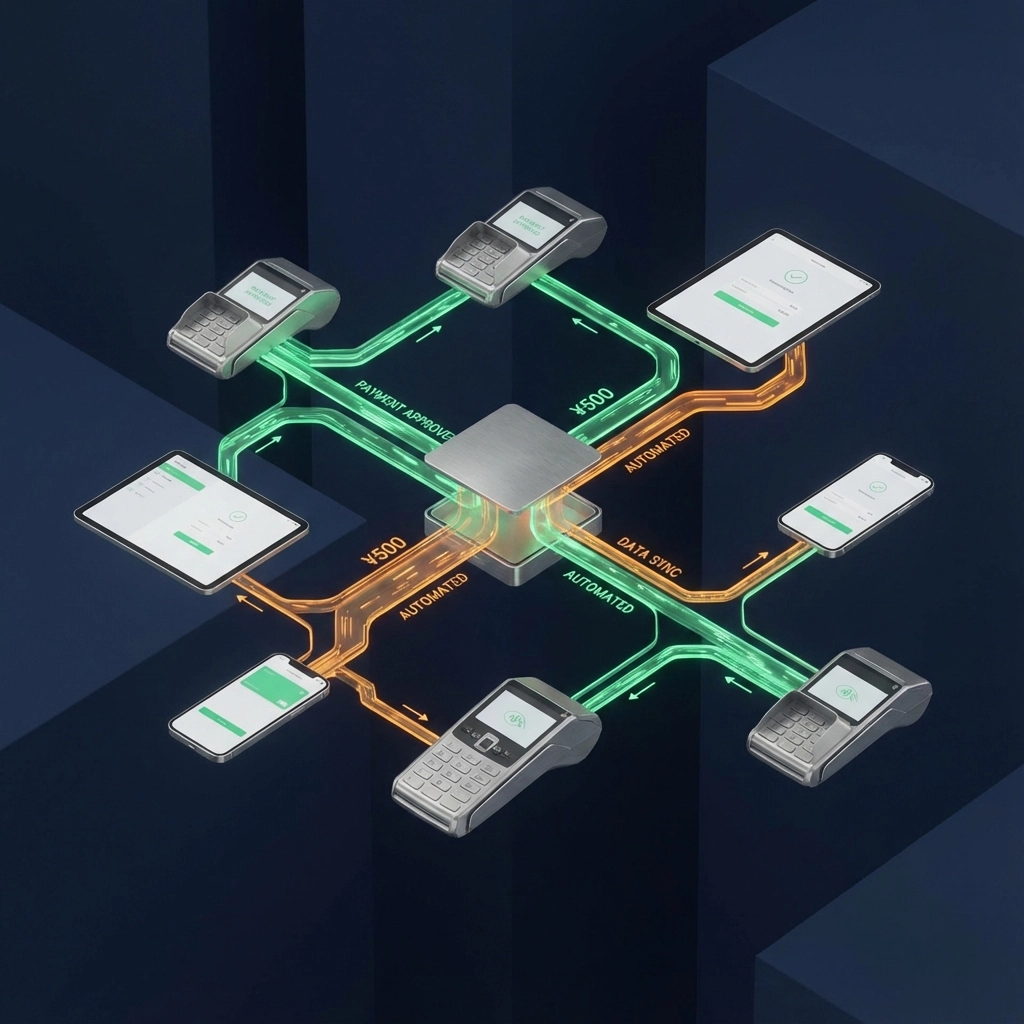

4. Integrate Your Payment Processors

If you're using Square, Stripe, PayPal, or any other payment processor for your Fresno business, you can connect these directly to your accounting software. Every sale, refund, or chargeback gets automatically recorded with the correct fees deducted.

This is especially clutch for retail businesses along Fashion Fair or restaurants in Tower District. Your daily sales summaries flow directly into your books without you touching a thing.

The hack: Connect all your payment processors to your accounting software. Set up rules to automatically categorize transaction fees, and let the system handle the daily sales entries. Your books will be more accurate, and you'll save hours each week.

5. Set Up Automatic Bill Pay (Strategically)

Before you panic, we're not suggesting you automate every bill payment. That's how you accidentally pay $500 for internet when you only agreed to $50. But strategic automation can save serious time.

Set up automatic payments for fixed expenses like rent, insurance premiums, and loan payments. These amounts don't change, so there's no risk of surprise charges. Variable expenses like utilities or credit card bills should still be reviewed before payment.

The hack: Create two categories of bills, fixed and variable. Automate the fixed ones and set up approval workflows for variables. Most accounting software can send you email alerts before variable payments go out.

6. Use Bank Rules and Categories Like a Pro

Every piece of accounting software has rules functionality, but most Central Valley business owners barely scratch the surface. You can create rules that automatically categorize transactions based on vendor name, amount, or transaction type.

For example, set up a rule that categorizes anything from "PG&E" as utilities, anything from "State of California" as taxes and licenses, and anything under $25 from coffee shops as meals and entertainment (we see you, Temple Coffee).

The hack: Spend 30 minutes setting up bank rules for your most common vendors and transaction types. Your software will learn your patterns and automatically categorize 80% of your transactions correctly.

7. Automate Your Monthly Reconciliation Process

Bank reconciliation doesn't have to be the monthly nightmare that keeps you up at 2 AM questioning your life choices. Modern accounting software can match your bank transactions to your recorded entries automatically.

Set up your software to download bank statements automatically at month-end. The system will match transactions, flag discrepancies, and even suggest corrections for common issues.

The hack: Schedule automatic bank statement downloads and set up matching rules for your most common transaction types. Your monthly reconciliation will go from a full-day ordeal to a 30-minute review.

The Support, Comply, Strategize Approach to Automation

At Tabs Bookkeeping, we believe every automation decision should support your business operations, ensure compliance with tax requirements, and position you for strategic growth.

Support: These automation hacks free up your time to focus on customer service, product development, or just taking a well-deserved break at Woodward Park.

Comply: Automated systems create better documentation, reduce errors, and make tax time less painful. Your CPA will thank you.

Strategize: Clean, automated books give you real-time insights into cash flow, profitability, and trends. You can make informed decisions instead of flying blind.

When DIY Becomes "Don't Try This at Home"

Look, automation is great, but it's not magic. If your books are already a mess, automation will just create organized chaos faster. Sometimes the smartest move is getting professional help to clean up your systems before you automate them.

If you're spending more than 10 hours a month on bookkeeping, if tax time makes you break out in stress hives, or if you're making business decisions based on your checking account balance instead of actual financial reports, it might be time to call in the professionals.

Ready to Automate Your Way to Freedom?

These seven automation hacks can transform your bookkeeping from a time-consuming chore into a streamlined system that works while you sleep. Start with one or two hacks, get comfortable with the process, then gradually add more automation.

Your future self, the one who's not stressed about bookkeeping every month, will thank you. And hey, you might even have time to enjoy one of those famous Central Valley sunsets instead of staring at spreadsheets.

Need help implementing these automation strategies or want to explore taking your bookkeeping completely off your plate? Let's chat about how we can support your Fresno business with systems that actually work.

Comments